The market value accounts for future growth prospects, and if the market anticipates high future earnings, the share price can be higher. These include changes in asset values, debt levels, stock buybacks, issuance of new shares, and changes in intangible assets’ value. When evaluating a company’s financial health, investors and analysts often rely on various financial ratios and metrics. One such metric is the book value per share, which provides insights into a company’s net worth on a per-share basis. In this article, we will explore the concept of book value per share, its calculation formula, components, significance, pros and cons, and more. Should the company dissolve, the book value per common share indicates the dollar value remaining for common shareholders after all assets are liquidated and all creditors are paid.

Book Value: Meaning, Formula, Calculation and Examples

When it comes to value investing, the book value per share is an essential determinant of a company’s intrinsic value. It can be used in conjunction with other financial ratios like the P/E ratio (Price to Earnings) and P/B ratio (Price to Book value). Investors often seek out companies that trade with a lower P/B ratio – typically under one – as these companies may be undervalued, offering potential for significant upside. Inversely, if a company does not pay dividends and retains its profits, it may result in an increased book value per share, as those retained earnings will add to the net assets of the company.

Reflects the Company’s Financial Health

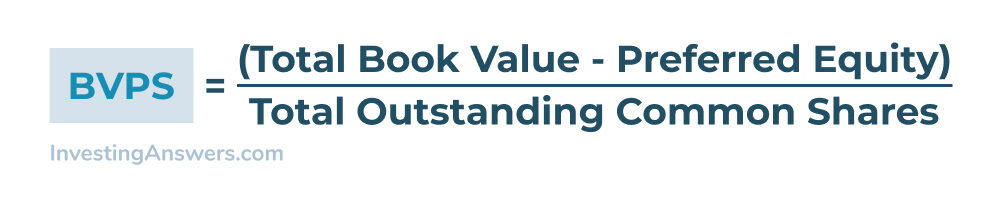

To get BVPS, you divide the figure for total common shareholders’ equity by the total number of outstanding common shares. To obtain the figure for total common shareholders’ equity, take the figure for total shareholders’ equity and subtract any preferred new property tax rebate program stock value. If there is no preferred stock, then simply use the figure for total shareholder equity. The book value per share represents the value of a company’s assets that shareholders would theoretically receive if the company were liquidated.

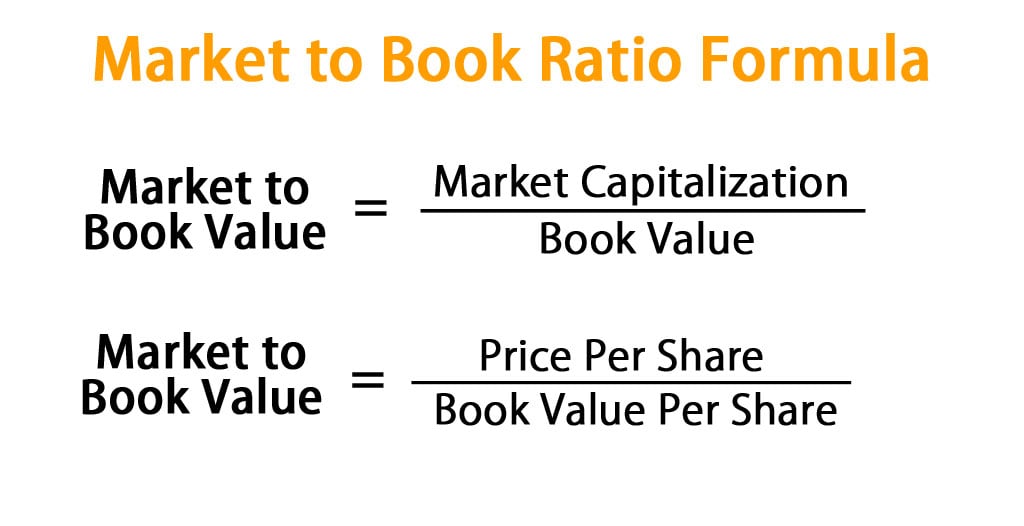

Price-to-Book (P/B) Ratio

Book Value Per Share is calculated by dividing the total common equity by the number of outstanding shares. The difference between a company’s total assets and total liabilities is its net asset value, or the value remaining for equity shareholders. The company generates $500,000 in earnings and uses $200,000 of the profits to buy assets, its common equity increases along with BVPS. If XYZ uses $300,000 of its earnings to reduce liabilities, common equity also increases. The book value of a share, also known as the “book price,” is the value of a company’s equity divided by the number of outstanding shares.

All About Investment Concepts on smallcase –

- The book value per share of a company is the total value of the company’s net assets divided by the number of shares that are outstanding.

- The book value per share is calculated using historical costs, but the market value per share is a forward-looking metric that takes into account a company’s earning power in the future.

- These include the exclusion of intangible assets’ value, the impact of inflation, potential inaccuracies due to accounting methods, and the exclusion of future growth potential.

- By representing the net asset value per share, it allows investors to assess the portion of assets allocated to each outstanding share.

Interpreting the book value per share can provide valuable insights into a company’s financial health. It’s essential to compare this value with those of similar companies in the same industry to gain a comprehensive perspective. As a result, the metric may not accurately represent the current value of certain assets.

This means that the market price of the company’s shares is 1.5 times higher than its book value per share. Investors can use this ratio to assess whether the stock is trading at a premium (P/B ratio above 1) or a discount (P/B ratio below 1) relative to its BVPS. It is important to understand that BVPS in the share market is different from the market value of a share. The market value is determined by the stock’s current market price, which can fluctuate based on supply and demand in the stock market. However, there are cases where high-growth companies may constantly have a higher market value per share compared to the book value per share.

In some cases, you may have identified a company with genuine hidden worth that hasn’t been widely recognized. Essentially, book value per share and market value per share are measures that investors use to gauge a company’s worth, but they approach it from two different perspectives. The term “book value” is derived from accounting lingo, where the accounting journal and ledger are known as a company’s books. The following image shows Coca-Cola’s “Equity Attributable to Shareowners” line at the bottom of its Shareowners’ Equity section. It’s one metric that an investor may look for if they’re interested in valuating Coca-Cola as a potential investment.

This is why it’s so important to do a lot of research before making any investment decisions. In closing, it’s easy to see why the book value per share is such an important metric. It’s a simple way to compare the value of a company’s net assets to the number of shares that are outstanding.

When the market value per share is lower than the book value per share, the company can be construed as undervalued and may become an attractive option for value investors. Conversely, when the market value per share is significantly higher than the book value per share, the company may be seen as overvalued, suggesting that its stock might be trading at a premium. Before discussing different factors, it’s important to remember that book value per share is essentially an indication of a company’s intrinsic worth, determined from its balance sheet data. This intrinsic value reflects a company’s net assets after adjusting for its liabilities.